Macroeconomics vs Microeconomics – Economics is omnipresent and form an integral part of our lives. Economics influences the prices of the goods and services we buy, as well as the income we earn at our jobs. The economic condition of the country whether may it be inflation or unemployment directly affects our finances, growth, and many other areas that permit us to be self-sufficient in our lives. We all use and have money. Suppose you have 200 dollars with you, the choice of using that money to pay off your bill or spend it on an outing is all an economic decision. This article on Macroeconomics vs Microeconomics attempts to analyze and understand these issues and its effects on investors.

Well before we go on to see the two most important branches of economics viz. microeconomics and macroeconomics and their relationship, lets first understand this interesting term economics. Economics is derived from a Greek word ‘Oikonomikos’. If we break the word up, ‘Oikos’, means ‘Home’, and Nomos’, means ‘Management’. Considering the entire society as a family it has unlimited wants which are ever increasing and sources that are available to satisfy them are limited. Hence economics is the study of how the available resources are managed and organized to deal with the needs and wants of the society.

Recommended courses

Download Corporate Valuation, Investment Banking, Accounting, CFA Calculator & others

Macroeconomics vs Microeconomics – Economics is omnipresent and form an integral part of our lives. Economics influences the prices of the goods and services we buy, as well as the income we earn at our jobs. The economic condition of the country whether may it be inflation or unemployment. Jan 27, 2019 Microeconomics and macroeconomics are two of the largest subdivisions of the study of economics wherein micro- refers to the observation of small economic units like the effects of government regulations on individual markets and consumer decision making and macro- refers to the 'big picture' version of economics like how interest rates are determines and why some countries'. Microeconomics vs. Microeconomics is the study of economics on the individual level, whereas macroeconomics is the study of economics on the national or global level. When we talk about a particular firm, group, family or an individual than it is microeconomics. And when we examine or talk about the firms, groups, or the.

The article on Macroeconomics vs Microeconomics is structured as below –

- Start studying Microeconomics vs. Learn vocabulary, terms, and more with flashcards, games, and other study tools.

- Macroeconomics is the branch of economics that looks at economy in a broad sense and deals with factors affecting the national, regional, or global economy as a whole. Microeconomics looks at the economy on a smaller scale and deals with specific entities like businesses, households and individuals.

Microeconomics and macroeconomics both focus on the allocation of scarce resources. Both disciplines study how the demand for certain resources interacts with the ability to supply that good to determine how to best distribute and allocate that resource among many consumers. Microeconomics is the study of particular markets, and segments of the economy. It looks at issues such as consumer behaviour, individual labour markets, and the theory of firms. Macro economics is the study of the whole economy. It looks at ‘aggregate’ variables, such as aggregate demand, national output and inflation.

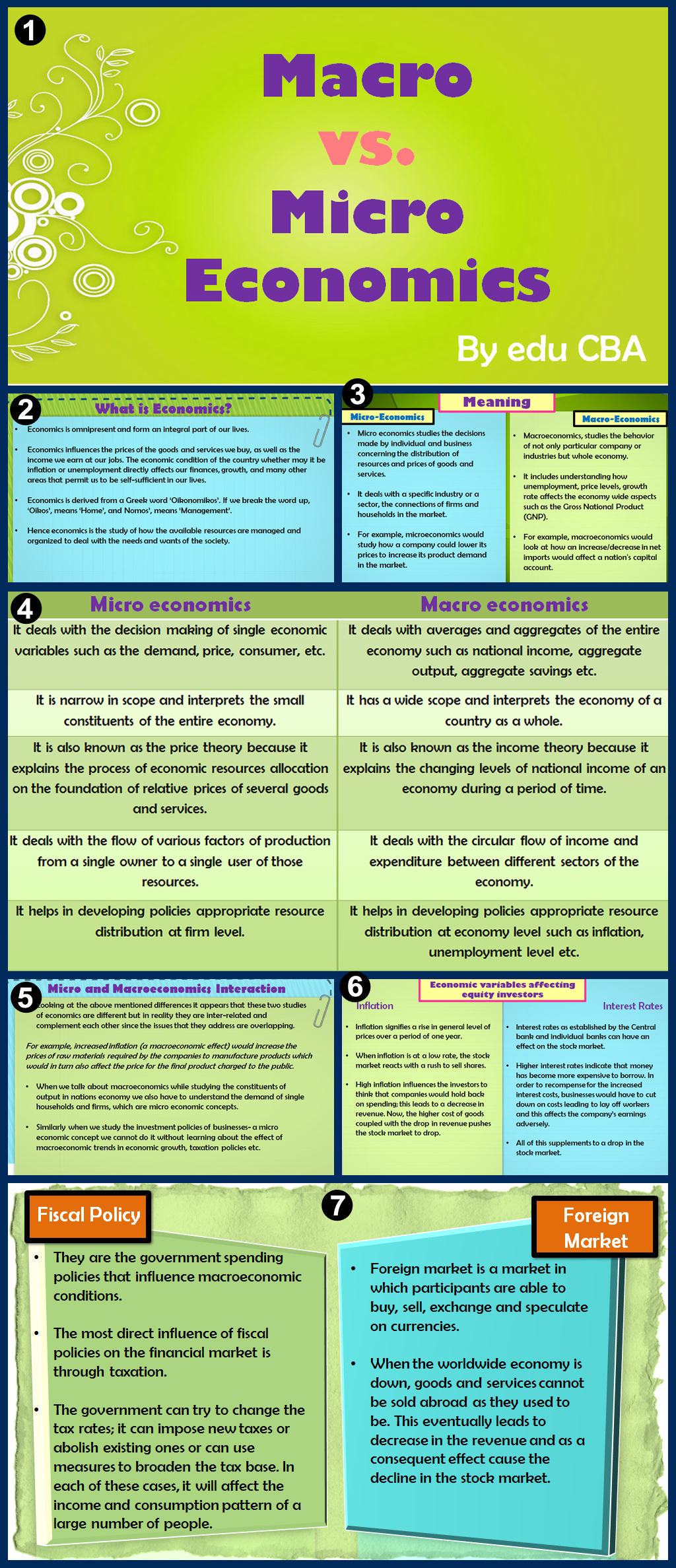

Macroeconomics vs Microeconomics Infographics

Learn the juice of this article in just a single minute, Macroeconomics vs Microeconomics

Understanding Macroeconomics vs Microeconomics

As the name suggests, Microeconomics studies the decisions made by individual and business concerning the distribution of resources and prices of goods and services. It deals with a specific industry or a sector, the connections of firms and households in the market. While saying so we also take into consideration the taxes and other regulations that have been created by governments. It primarily focuses on the supply, demand and other forces that define the price levels of good and services in the economy.

Microeconomics would study how a company could lower its prices to increase its product demand in the market.

On the other hand Macroeconomics, studies the behavior of not only particular company or industries but whole economy. It includes understanding how unemployment, price levels, growth rate affects the economy wide aspects such as the Gross National Product (GNP).

Macroeconomics would look at how an increase/decrease in net imports would affect a nation’s capital account.

Looking at the two differences macroeconomics vs microeconomics we could say that when we study an individual paper mill manufacturing paper, it would be microeconomics but if we study the whole paper manufacturing sector of the economy it would be macroeconomics.

4.9 (3,296 ratings)

The following table would briefly distinguish macroeconomics vs microeconomics examples;

| Microeconomics | Macroeconomics |

|---|---|

| It deals with the decision making of single economic variables such as the demand, price, consumer, etc. | It deals with averages and aggregates of the entire economy such as national income, aggregate output, aggregate savings etc. |

| It is narrow in scope and interprets the small constituents of the entire economy. | It has a wide scope and interprets the economy of a country as a whole. |

| It is also known as the price theory because it explains the process of economic resources allocation on the foundation of relative prices of several goods and services. | It is also known as the income theory because it explains the changing levels of national income of an economy during a period of time. |

| It deals with the flow of various factors of production from a single owner to a single user of those resources. | It deals with the circular flow of income and expenditure between different sectors of the economy. |

| It helps in developing policies appropriate resource distribution at firm level. | It helps in developing policies appropriate resource distribution at economy level such as inflation, unemployment level etc. |

Do Macroeconomics vs Microeconomics interact with each other?

Looking at the above mentioned differences between macroeconomics vs microeconomics it appears that these two studies of economics are different but in reality they are inter-related and complement each other since the issues that they address are overlapping.

Increased inflation (a macroeconomic effect) would increase the prices of raw materials required by the companies to manufacture products which would in turn also affect the price for the final product charged to the public.

Microeconomics and Macroeconomics are both exploring the same things but from different viewpoints. When we talk about macroeconomics while studying the constituents of output in nations economy we also have to understand the demand of single households and firms, which are micro economic concepts. Similarly when we study the investment policies of businesses- a microeconomic concept we cannot do it without learning about the effect of macroeconomic trends in economic growth, taxation policies etc.

How macreconomic vs microeconomic variables affect equity investors?

The stock market gets affected by various economic and social factors. It is important that every finance professional or investor should be aware of these factors before deciding to invest in it.

If there is increasing inflation in the economy it would have consequent effects on the stock market.

Pro Tools M-Powered also includes a “Rating editor” to help you as it pertains to music notation. The bottom line is, HD is actually a beefed up version of regular Pro Tools. Its recommended tool for musician industries.Pro Tools Keygen is faster than the prior version of the software. Many of the people like this software because it provides a great quality of stuff. HD offers a large intensify in a number of available video songs, so if your goal is by using Pro Tools for advanced audio tracks and video tutorial syncing you will want to consider HD.The features of the program are intensive you need to include advanced MIDI sequencing, plenty of effects, and digital instruments.

Inflation and Deflation

Inflation signifies a rise in general level of prices over a period of one year. Inflation can have contrary effects on the stock market. When inflation is at a low rate, the stock market reacts with a rush to sell shares. High inflation influences the investors to think that companies would hold back on spending; this leads to a decrease in revenue. Now, the higher cost of goods coupled with the drop in revenue pushes the stock market to drop.

There have however been exceptions, when there have been sustained decline in the price level of goods and services. This occurrence is called deflation. While deflation would sounds like it should be received well by investors, it actually is a reason for a drop in the stock market since they perceive deflation as the consequence of a weak economy.

This inflation can have significant impact on other macroeconomic variables; let’s understand where and how;

- Exchange Rate: Persistent prevalence of higher inflation in a country (say Country P) comparative to the inflation in another country (say Country Q) generally leads to depreciation of a currency in country P.

- Interest Rates: When the level of price rise each unit of currency can buy fewer goods and services than before, implying a reduction in the purchasing power of the currency. So, people with excess funds demand higher interest rates, as they want to protect the returns of their investment against the adverse impact of higher inflation. As a outcome, with rising inflation, interest rates tend to rise. The reverse happens when inflation declines.

- Unemployment: There is an opposite relationship between the rate of unemployment and the rate of inflation in an economy. It has been perceived that there is a stable short run trade off between unemployment and inflation.

Interest Rates

From the lender’s perspective, interest can be thought of as an “opportunity cost’ or “rent of money” and interest rate as the rate at which interest accumulates over a period of time for the amount given as loan. From a borrower’s perspective, interest rate is the cost of capital i.e. it is the cost that a borrower has to sustain to have access to funds.

Interest rates as established by the Central bank and individual banks can have an effect on the stock market. Higher interest rates indicate that money has become more expensive to borrow. In order to recompense for the increased interest costs, businesses would have to cut down on costs leading to lay off workers. Also the company cannot borrow as much as it used to, and this affects the company’s earnings adversely. All of this supplements to a drop in the stock market.

Fiscal Policy

They are the government spending policies that influence macroeconomic conditions. Through fiscal policy, regulators try to improve unemployment rates, control inflation, stabilize business cycles and influence interest rates in an effort to control the economy.

The most direct influence of fiscal policies on the financial market is through taxation. The government can try to change the tax rates; it can impose new taxes or abolish existing ones or can use measures to broaden the tax base. In each of these cases, it will affect the income and consumption pattern of a large number of people. Dependent upon the tax measure, it will have a positive or a negative impact on the financial market. For example, if personal income tax rate is lowered then it is likely to see an upturn the disposable income of people and can have a positive impact on the financial markets through an enhanced level of financial savings. On the other hand, introduction of a long-term capital gains tax 10 may have the adverse impact on the market.

Foreign Market

Foreign market is a market in which participants are able to buy, sell, exchange and speculate on currencies.

When the worldwide economy is down, goods and services cannot be sold abroad as they used to be. This eventually leads to decrease in the revenue and as a consequent effect cause the decline in the stock market. If foreign stock exchanges start weakening or experience sharp declines, a ripple effect can be anticipated. This eventually results in the overall drop in a global stock market.

After understanding all this we could definitely comprehend that both Macroeconomics vs Microeconomics provide important tools for any finance professional and should be studied together in order to completely comprehend how corporations function and make revenues and thus, how a whole economy is managed and continual.

Recommended Articles

Here are some articles that will help you to get more detail about the Macroeconomics vs Microeconomics so just go through the link.

Page Contents

Main Difference

Economics is the branch of knowledge that deals with the production, consumption, and transfer of wealth. The other famous definition of the economics tells that it is the relation of the scarcity of the commodities and their demand. Following it, we can determine that economics is the broader concept, as it is the knowledge which has both the basic essence of arts and sciences. Even if we are not an accounting or banking students, we came across the concepts of economics in daily lives when we have to make choices in between spending and saving. The economics is mainly divided into two types known as microeconomics and macroeconomics. Microeconomics is the study of economics on the individual level, whereas macroeconomics is the study of economics on the national or global level. When we talk about a particular firm, group, family or an individual than it is microeconomics. And when we examine or talk about the firms, groups, or the families in a collective manner, it would be the macroeconomics.

Comparison Chart

| Microeconomics | Macroeconomics | |

| Definition | Microeconomics is the study of economics at the individual or smaller scale | Macroeconomics is the study of economics at national, regional, or global level. |

| Example | When particular firm, group, family or an individual is under consideration with terms to economics than it is the microeconomics. | When the firms, groups, or the families are discussed in a collective manner with witnessing it’s global or national impact, then it is macroeconomics. |

| Deals with Issues | Demand, supply, product pricing, factor pricing, production, consumption, economic welfare, etc | National income, general price level, distribution, employment, money, etc. |

| Usage | The price determination and classifying of the product into necessity or luxury item is also done with regards to the microeconomics. | Some of the most prominent uses of macroeconomics are to set the general price level for the products and to dealt with issues like inflation, poverty, and unemployment. |

What is Microeconomics?

Microeconomics Vs Macroeconomics Quizlet

Microeconomics is the study of economics at the individual or smaller scale. The study of a firm, the family at the individual level, is done in this type of economics. As we know that micro means small, the microeconomics has the less broad spectrum, and it is more concerned with the concept of individuality. The microeconomics mainly deals with the issues like demand, supply, product pricing, factor pricing, production, consumption, economic welfare, etc. The price determination and classifying of the product into necessity or luxury item is also done with regards to the microeconomics. The other benefit of the microeconomics is the determination of prices of products after evaluating the price of different factors of production. As we know that land, labor, capital and enterprise are the factors of production; in the microeconomics, each of the factors is looked individually and then the price for the certain product is determined. In other words, we can say that the specific or individual business is studied in microeconomics.

What is Macroeconomics?

Macroeconomics is the study of economics at national, regional, or global level. In this type of economics the issues related to national interest, global beneficial are being discussed. It mainly revolves around the issues like national income, general price level, distribution, employment, money, etc. It is useful in dealing with economic issues like inflation, defloration, and unemployment. As we know that macro means large, in this type of area the collective analysis is made, which can either be on the city-district level or even on the national level. After getting into the economic data’s of different countries, one can know about these issues at the global level. The top-to-down approach is adopted in the macroeconomics while analyzing the data, unlike the bottom to top approach as in the case of microeconomics. Some of the most prominent uses of macroeconomics are to set the general price level for the products and to dealt with issues like inflation, poverty, and unemployment.

Microeconomics vs. Macroeconomics

- Microeconomics is the study of economics on the individual level, whereas macroeconomics is the study of economics on the national or global level.

- When we talk about a particular firm, group, family or an individual than it is microeconomics. And when we examine or talk about the firms, groups, or the families in a collective manner, it would be the macroeconomics.

- The microeconomics mainly deals with the issues like demand, supply, product pricing, factor pricing, production, consumption, economic welfare, etc. On the other hand, mainly revolves around the issues like national income, general price level, distribution, employment, money, etc.

- The price determination and classifying of the product into necessity or luxury item is also done with regards to the microeconomics. On the other hand, Some of the most prominent uses of macroeconomics are to set the general price level for the products and to dealt with issues like inflation, poverty, and unemployment.